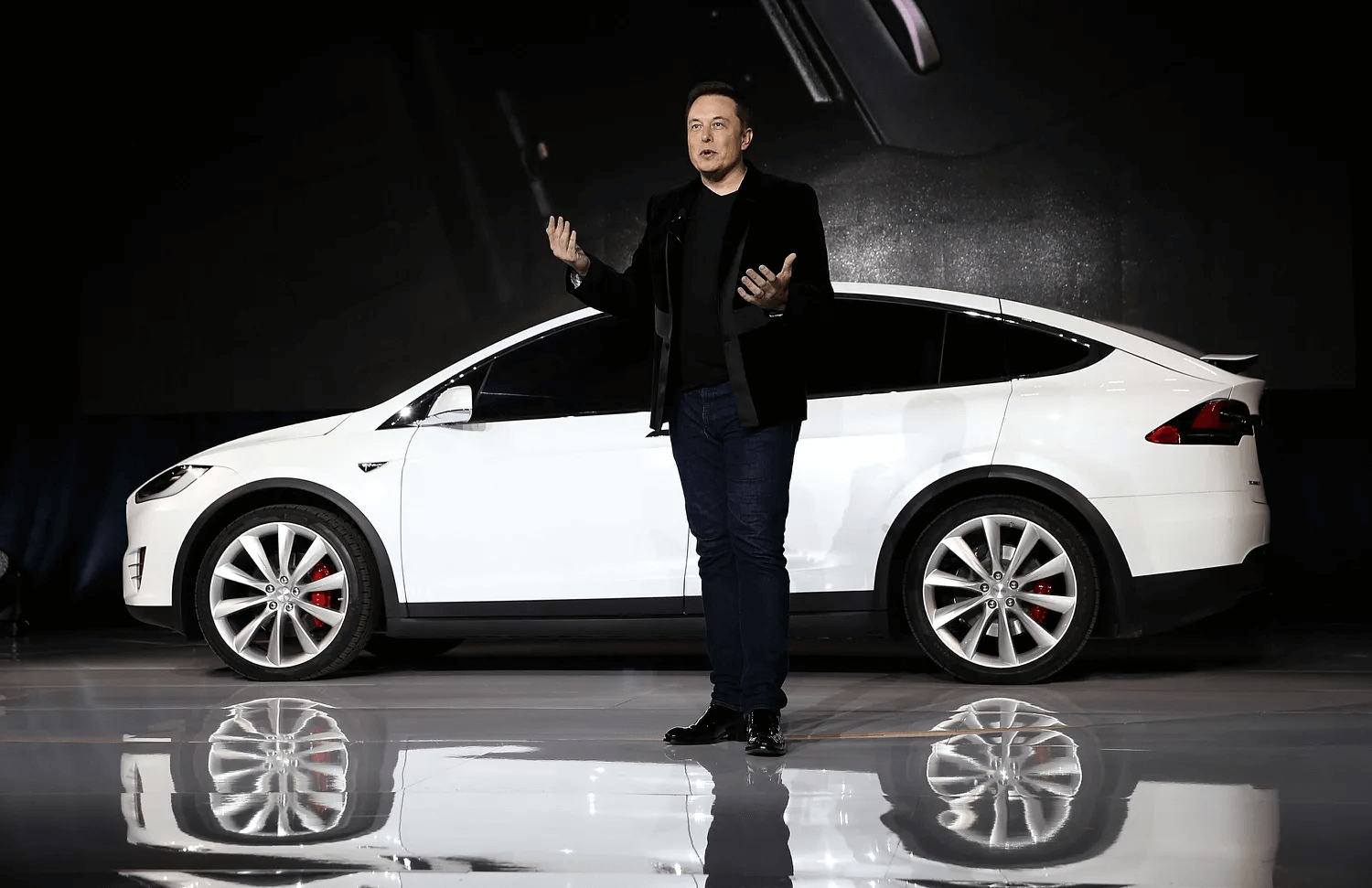

Tesla (TSLA), a relatively recent entrant to the automotive world, has swiftly risen to prominence as a powerhouse in the electric vehicle (EV) industry. The company is known for its secrecy when it comes to its supplier network, carefully guarding this information to protect trade secrets and prevent competitors from securing a competitive advantage or cornering essential parts.

Thanks to the efforts of determined researchers, some of Tesla’s suppliers have been uncovered. While the company manufactures key electric components in-house—like the electric motor, battery pack, and charger—Tesla is also working on producing its own batteries and microchips. For other essential parts, however, it turns to a diverse network of suppliers scattered across the U.S., Europe, and Asia, ensuring a global reach for the parts it needs.

Key Takeaways

- Tesla Motors has built a strong reputation for creating innovative and visually appealing electric vehicles.

- To assemble its cars, Tesla depends on a broad network of suppliers that provide essential components.

- These suppliers offer a wide range of parts, from traditional car components and EV-specific elements to raw materials such as steel, industrial products, and minerals.

- The accelerating shift towards electric vehicles opens up substantial growth opportunities for suppliers in the industry.

- As the EV market expands, Tesla’s supplier ecosystem could become an appealing avenue for investment.

Are Supplier Stocks a Smarter Investment Option?

For investors keeping an eye on the expanding EV market, focusing on suppliers—alongside manufacturers—could be a savvy strategy. As major automakers continue to double down on their electric vehicle commitments, the outlook for EV component suppliers looks increasingly favorable. Here’s why these suppliers may offer compelling investment opportunities:

- Diversification: By investing in both EV makers and their suppliers, you can spread out risk while tapping into growth across the entire sector.

- Value: If the stock prices of EV manufacturers, such as Tesla, seem inflated, supplier stocks may provide a more affordable and potentially more profitable alternative.

- Performance: The rapid shift toward electric vehicles, bolstered by government incentives and regulations, is fueling consumer demand. This surge in demand means increased EV production and, by extension, a growing need for supplier products.

As competition among suppliers is bound to heat up with the market’s expansion, standout companies have the chance to deliver significant rewards for investors willing to look beyond the manufacturers themselves.

How Can You Invest in Tesla?

Tesla, a publicly traded company, is listed on the Nasdaq under the ticker symbol TSLA. If you’re looking to invest, there are two primary routes you can take:

- Direct Investment: Buy Tesla shares directly through a brokerage or online trading platform. This method gives you the opportunity to own a piece of Tesla and directly benefit from its performance in the market.

- Indirect Investment: Alternatively, you can invest in exchange-traded funds (ETFs) or mutual funds that have Tesla as part of their holdings. This allows for greater diversification, as your investment is spread across a mix of companies, with Tesla included among them.

Both options offer a way to engage with Tesla’s growth, but the right choice depends on your personal investment strategy and risk appetite.

The Bottom Line

As one of the globe’s most influential automakers, Tesla relies on a vast and complex supply chain. Its components come from a diverse range of suppliers, from lithium mines to cutting-edge computer chip manufacturers. Although Tesla tends to keep some supplier relationships confidential to maintain a competitive edge, several of its key partners have emerged as well-known players within the industry. This network is crucial to Tesla’s continued innovation and production capacity.

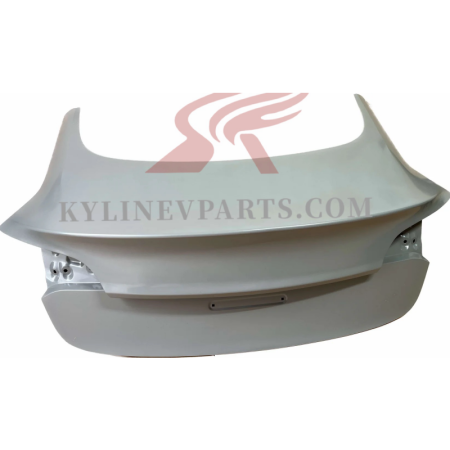

How to Order Tesla Parts?

Kylin EV Parts Ltd is located in Guangzhou, the hub of China’s automotive parts industry. Established in 2013, we focus on the supply chain of new energy automotive parts, providing brand solutions for entire vehicle series from a screw to exterior components, connecting the upstream and downstream supply chains, and forming strategic alliances with production factories through customization, alliance. Adhering to the principle of ensuring the quality of a component is equal to protecting the safety of a family.

In 2022, our international trade department was established, focusing on the integration of Tesla, VW, and BYD, as well as aftermarket modifications. As China’s premier B2B supplier, we offer a comprehensive service in integrating EV spare parts for numerous foreign sellers, both online and offline.

We extend a cordial invitation to collaborate with foreign dealers and explore OEM and ODM partnerships for our products. With our commitment to the most professional service, the highest quality products, and the most reasonable prices, we endeavor to provide unparalleled support.