Are Tesla Parts Expensive? Understanding the Real Cost Structure Behind the EV Aftermarket

The Origin of Tesla’s “High-Cost” Reputation

Tesla’s reputation for high repair costs began with an obvious but often misunderstood fact: Tesla OEM parts and official repair services are priced noticeably higher than those of many traditional gasoline vehicles.

Some of these premiums result from the complexity of EV engineering, but part of it also stems from the way Tesla manages its aftersales ecosystem and restricts access to genuine Tesla parts. This naturally influences how both consumers and professionals answer the question: “Why are Tesla parts so expensive?”

When owners take their car to a Tesla service center, they encounter not only expensive components but also premium labor rates and proprietary diagnostics that cannot be replicated in most independent workshops. This creates the impression that Tesla vehicles are inherently expensive to maintain—a perception reinforced by news headlines about high Tesla repair cost, rising insurance pricing, and stories of costly collision repairs on Model S, Model X, Model 3, and Model Y. Yet, understanding why these parts cost more is the key to understanding where the Tesla parts cost aftermarket opportunity lies, and how distributors can turn “expensive” into “profitable” by leveraging Tesla OEM vs aftermarket parts price differences.

Why Tesla OEM Parts Are Structurally Expensive

Tesla vehicles integrate highly sophisticated systems—multi-camera sensor suites, aluminum body structures, high-voltage electronics, advanced thermal regulation, and tightly integrated control modules. These components are inherently more costly to design, test, and manufacture than many of their internal-combustion counterparts, which directly affects the perceived answer to “Are Tesla parts expensive?” especially when customers compare Tesla maintenance costs vs traditional vehicles from brands like BMW or Mercedes.

Components such as autopilot cameras, radar sensors, high-voltage controllers, battery thermal management assemblies, and smart ECUs must pass rigorous safety and compliance testing. The costs of R&D, validation, and ongoing software integration are baked into the pricing of OEM Tesla parts, and they are reflected in every Tesla parts price list used by official service centers.

Additionally, Tesla maintains a deliberately closed supply chain, controlling sourcing, pricing, and distribution. OEM parts typically move only through authorized channels, which protects safety and consistency but also keeps prices at a premium compared with independent aftermarket Tesla parts suppliers and specialized Tesla parts wholesale supplier networks.

The Real Reason OEM Parts Do Not Enter Open Distribution

Contrary to popular belief, Tesla does not restrict OEM parts simply to “maintain a monopoly.” The deeper—and far more practical—reason is risk control.

In the EV world, a repair done incorrectly is not merely “bad workmanship”—it can become a life-safety hazard. If OEM Tesla parts were easily available, unqualified workshops would inevitably attempt repairs involving components that require stringent handling procedures and calibrated diagnostic tools.

When this happens, the consequences can be severe: Improper high-voltage installation can cause electrical short circuits; incorrect battery housing or sealing can lead to thermal runaway; improperly installed airbag modules may fail during collisions; misaligned cameras and sensors can cripple ADAS and autopilot; and poorly serviced thermal systems can cause dangerous overheating. Whenever a repaired EV catches fire or malfunctions, the public rarely blames the workshop—they blame the brand.

This creates a risk structure unique to EVs: EVs tolerate no repair errors—not even small ones. As a result, Tesla enforces strict controls to protect both users and its own brand: OEM parts stay within authorized channels, diagnostics require proprietary access, critical repairs are restricted to certified workshops, and the supply chain remains intentionally closed.

This safety-driven model is exactly what pushes distributors and repair networks to explore high-quality aftermarket Tesla parts and reliable used components—and it is why the aftermarket exists at all. For many markets, the question shifts from “are Tesla parts expensive?” to “how can we safely reduce Tesla repair costs using the right mix of OEM, aftermarket, and used parts?”

OEM vs Aftermarket: Price Differences That Shape Market Demand

Once vehicles exit warranty, repair networks naturally start asking: “Are Tesla parts expensive when compared to aftermarket options?” In many high-rotation categories, the answer is a decisive yes.

The price gap between OEM and aftermarket Tesla parts can be dramatic, especially in collision parts and electronic modules that are frequently replaced as EV fleets age. Consider several market-typical comparisons that reflect widely observed global pricing patterns for Tesla components:

The Model 3 front bumper, which costs around USD 900–1200 in the OEM channel, may cost only 180–350 in aftermarket form Model Y LED headlamp, priced between USD 800–1500 as an OEM Tesla part, often ranges from 200–380 as a high-quality aftermarket alternative. Camera and AP sensor modules, which often retail for 200–350 USD in OEM form, may be available from reputable aftermarket suppliers in the 40–90 USD range, answering the question practically, “How much do Tesla parts cost to replace?”

For larger modules, such as MCU assemblies on Model S or Model X, OEM pricing can exceed 1600–2200 USD, whereas refurbished or aftermarket Tesla units typically range between 400–700 USD. These differences are not marginal—they fundamentally reshape the economics of Tesla maintenance, influencing Tesla repair cost after warranty, insurance calculations, and distributor inventory planning.

This is also where well-managed Tesla parts distribution becomes critical: by leveraging a curated Tesla aftermarket parts price comparison and supply chain, distributors can significantly reduce end-user repair costs while maintaining reliability, making the answer to “are Tesla parts expensive?” far more nuanced than a simple yes or no.

Which Tesla Components Remain Truly Expensive?

Although many parts now have cost-effective alternatives, several categories will remain structurally expensive due to safety relevance, technical complexity, or tight OEM control. These include battery packs and key high-voltage components, core MCU and integrated control modules, ADAS sensor suites (cameras, radar, ultrasonic sensors), airbag and SRS systems, aluminum structural components, and high-precision thermal management assemblies.

These high-cost zones define where OEM dependence persists and where cautious sourcing is essential. For distributors, this means recognizing which parts should remain OEM-only or OEM-centric, and which areas are better suited for certified aftermarket Tesla parts or high-grade used components, especially when dealing with critical systems such as ADAS sensor replacement, Tesla autopilot camera repair, or Tesla battery module work.

Where Aftermarket Pricing Creates Real Opportunity

Conversely, a large category of Tesla components is no longer tied to OEM pricing. This is where the most attractive opportunities reside for distributors looking to enter or scale within the Tesla aftermarket.

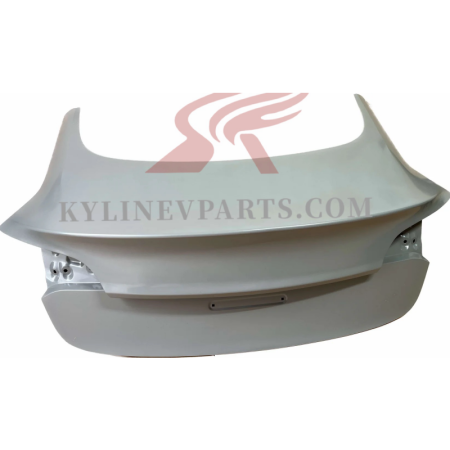

Body panels such as fenders, hoods, and trunk lids, a wide range of interior trims and plastic components, frequently replaced non-electronic structural parts, and high-volume wear-and-tear items are increasingly well served by the aftermarket.

In many markets, there is also a growing supply of used and salvage Tesla parts. For properly qualified workshops and distributors with robust quality control processes, these parts represent an additional way to keep repair costs down while maintaining functional integrity. In this context, Tesla parts are not uniformly expensive—only certain categories are structurally costly, while others offer room for competitive pricing and healthy margins through Tesla aftermarket parts wholesale and regional Tesla parts wholesale supplier programs.

For distributors, the key is to differentiate clearly between “structurally expensive” Tesla parts and “competitively priced” segments where aftermarket and used parts can safely replace OEM. That differentiation is where the highest commercial value lies, especially for businesses positioning themselves as specialist Tesla parts wholesale and distribution hubs.

How Distributors Reduce Tesla Repair Costs in Real Markets

Global distributors increasingly adopt a mixed-inventory strategy to address Tesla’s repair cost structure rather than relying exclusively on OEM channels. High-rotation parts such as cameras, suspension components, lamps, and bumper assemblies become cornerstone SKUs in a well-structured Tesla parts catalog, alongside selected high-quality electronic and body components for Tesla collision repair cost breakdown optimization.

Model-specific planning also matters: Aging Model S and Model X fleets are entering their heavy repair cycle, while Model 3 and Model Y vehicles dominate accident-part demand due to sheer fleet size. By aligning inventory with these lifecycle stages, distributors can anticipate which Tesla parts will be in the highest demand—especially in markets where EV adoption is reaching its second decade, and Tesla repair costs after warranty become a daily question for workshops and insurance companies.

As vehicles transition out of warranty, independent repair networks naturally move away from OEM-only sourcing and toward blended models:

OEM where required, aftermarket where cost-effective, and used or refurbished where safe, legal, and supported by adequate technical guidance. In such a strategy, the question “Are Tesla parts expensive?” becomes less about cost and more about sourcing intelligence and access to the right Tesla aftermarket parts for distributors.

Global Price Differences and the Expanding Tesla Aftermarket

Tesla’s global aftermarket does not evolve uniformly, and these regional differences matter for distributors deciding how to approach Tesla parts wholesale and long-term inventory planning.

In Europe, high accident-repair demand and dense EV populations fuel strong growth in collision and body-related parts and create a strong pull for Tesla aftermarket body parts suppliers.

In North America, high labor costs accelerate the shift toward high-quality aftermarket Tesla parts, as shops look to keep total repair invoices under control while remaining competitive.

In the Middle East, exterior components face a high replacement frequency due to climate and usage conditions, driving consistent demand for bumpers, lamps, and exterior trims sourced via Tesla parts bulk purchase.

In Southeast Asia, where import duties and logistics costs are significant, aftermarket pricing becomes particularly attractive as a way to keep EV ownership viable and manage Tesla EV parts cost comparison against other brands.

Across all of these markets, the underlying strategic question is moving beyond “are Tesla parts expensive?” to a more forward-looking version: How can cost, safety, and availability be balanced through the right mix of OEM, aftermarket, and used Tesla parts, supported by the right Tesla parts wholesale supplier?

FAQ: Common Questions About Tesla Parts Cost

Is Tesla expensive to maintain compared with traditional vehicles?

For early years under warranty, Tesla’s maintenance cost can be comparable or even lower than many premium ICE brands. After warranty, however, Tesla repair costs can feel higher if repairs are done only through OEM channels. When high-quality aftermarket Tesla parts and used components are introduced, the overall cost can drop significantly.

Do Tesla parts get cheaper over time?

As more vehicles enter the aftermarket phase and more suppliers develop Aftermarket Tesla parts, pricing pressure generally increases, and availability improves. This is particularly visible in high-volume models such as Model 3 and Model Y, where Tesla Model 3 parts costs and Tesla Model Y parts costs have gradually become more competitive thanks to a growing ecosystem of Tesla aftermarket parts wholesale providers.

Are aftermarket Tesla parts reliable?

As with any vehicle brand, the answer depends on the supplier. Certified and thoroughly tested aftermarket Tesla parts from professional distributors can offer reliability close to OEM at a fraction of the cost. This is why choosing the right Tesla replacement parts for distributors and repair networks is critical for long-term business.

Conclusion: Tesla Parts Are Not Simply Expensive—They Are Structurally Expensive

The cost of Tesla parts is not arbitrary; it reflects engineering complexity, safety requirements, and a uniquely controlled supply-chain environment. High-voltage architecture, advanced software integration, and stringent quality expectations all contribute to the premium pricing of OEM Tesla parts. At the same time, these very constraints create space—and necessity—for a mature, responsible aftermarket built around Tesla OEM vs aftermarket parts cost optimization.

For distributors evaluating entry or expansion into the EV category, the question is no longer just “Are Tesla parts expensive?” But rather: How can we participate in the aftermarket ecosystem that reduces those costs while maintaining reliability and safety? In this context, capable, vertically integrated suppliers become essential for building a sustainable Tesla parts business and answering, in practice, “how to reduce Tesla repair costs” in their local markets.

Why Kylin EV Parts Supports the Future of Tesla Aftermarket Distribution

As Tesla’s aftermarket enters its fastest growth phase, repair networks and wholesale distributors increasingly need partners who combine product range, technical understanding, and long-term reliability. Kylin EV Parts has built exactly this capability for the global EV market, positioning itself as a specialist Tesla aftermarket parts wholesale andMTesla parts wholesale supplier.

With a catalog of over 2,000 verified aftermarket and used Tesla parts, cross-brand EV coverage (including Tesla, BYD, Zeekr, Li Auto, VW ID, XPen,g and others), and a supply chain designed for both volume distribution and specialized part sourcing, Kylin EV Parts operates not as a simple trading intermediary but as an integrated EV parts solution provider.

Our internal QC processes, reverse-development capabilities, and technical support infrastructure are structured to help distributors build a stable, competitive Tesla parts offering and answer local market questions like “Where to find reliable Tesla aftermarket parts for distributors?”

For distributors evaluating Tesla aftermarket opportunities or seeking SKU recommendations tailored to their market conditions, our resource hub provides additional technical insights and product information: Tesla aftermarket parts catalog. This, combined with broader EV product lines and ongoing market feedback, allows us to support partners as they answer the real strategic question: not simply “are Tesla parts expensive?”, but “how can we turn that cost structure into a sustainable, profitable EV aftermarket business?”